Get your SMSF into top gear!

Self-Managed Super Funds can help you to invest in items that aren't on the investment menu of larger super funds. The commercial premises you use to run your business is a popular example.

But what if you're a small business owner and you simply don't have enough money in super to buy direct property? What options do you have?

Traditionally, you may have had to consider borrowing the balance yourself and then becoming joint owner of the property with your super fund. Perhaps this would have been set up through a trust structure to give you flexibility later on.

However, since 2007, SMSFs have been permitted to borrow directly from the bank (or another lender) to help with purchasing investments such as property. For this to be allowed, there are a number of strict criteria that need to be met. For example, it must be established that the lender has no recourse to other assets of the SMSF in the event of default.

In addition, specific legal documentation must be in place in relation to the ownership of the investment. A special type of trust—known as a bare trust—must be in place to hold the investment on behalf of the super fund until the loan is extinguished. If this is not structured correctly, the fund may be breaching its investment rules.

But if all the requirements are satisfied, borrowing through your super fund can open a whole new range of opportunities.

Let's use an example to see how this works, and how it benefits small business owners.

Rogerson & Son Real Estate

Bob and Jan Rogerson had always planned for their son, Robert, to take over the real estate agency once they had retired. Unfortunately, due to Bob's health problems, they are retiring earlier than they expected and will immediately hand over the reins to Robert.

The business has been leasing the premises from the previous owner, however, Robert believes that "rent money is dead money". He wants to buy the premises for himself, but at age 35 and with his own home mortgage, he doesn't have the capacity to do so.

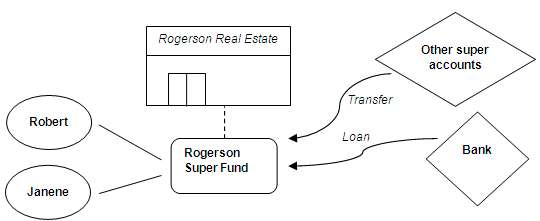

Robert and his wife, Janene, both have superannuation accounts, with a combined balance of $170,000. They are interested in a smart way to use these savings to purchase the premises (valued at $320,000) as soon as possible.

Borrowing through SMSFs

In this example, one of the benefits to Robert and Janene of investing through an SMSF is that they can use their existing superannuation monies as a deposit on the purchase of the business premises. This is especially useful if they have limited equity in their own names, such as through the family home.

Here's how an SMSF might assist them to purchase the premises sooner.

Here, the SMSF has borrowed from the bank to make up the difference between Robert and Janene's existing super and the purchase price of the premises. Over time, the SMSF will use rental income, plus super contributions received from Robert and Janene, to repay the debt to the bank.

It's important to note here that the bank is not likely to lend up to 80% or 90% of the property value, as with normal investment loans. It is more likely to be around 60% to 70%, so Robert and Janene may find they need to build their super for another year or two before making the purchase.

But is it better to borrow personally if you can?

Most property investors like the idea that any excess of expenses over the rent received can be deducted against your other income. In other words, negative gearing can be a key factor in a wealth-building strategy using debt.

Within the SMSF environment, the tax benefits of negative gearing are not so apparent. The excess deductions cannot be claimed by the individual members, only by the fund itself. This outcome should be weighed against the advantages of SMSF borrowing, including the raising of a deposit as noted above.

So if Robert and Janene had enough equity to purchase the property personally, should they do so? Unfortunately, there's no simply answer. The best approach will depend on their individual circumstances, such as additional financial commitments, future plans for the business, and any other investments that are part of their wealth-creation plan.